Hi, welcome to Error Margin! I would like my first blog post to be something impactful that'll be immediately applicable to my readers’ lives, so I'm writing about how to arbitrage the hell out of life insurance companies if you're able to time travel cheaply.

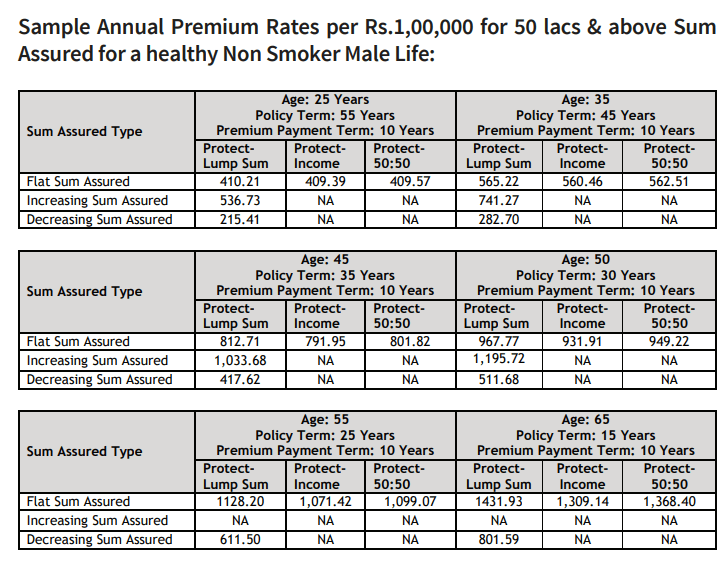

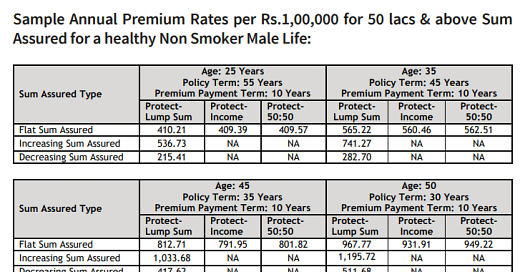

We all know life insurance premiums get more expensive as you get older, because your chance of death in any given year increases with age (citation needed). Here’s a table where we can see this happening.1

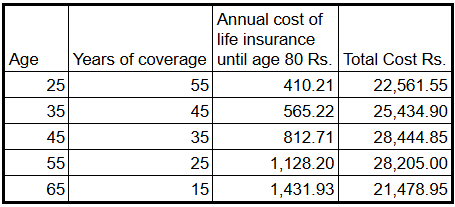

At first glance these numbers don’t seem too crazy, but let’s figure out the total cost of the policy assuming you want coverage until you’re 80.

And now the arb becomes clear. Let’s suppose you’re a healthy non-smoking Indian male aged 55. All your friends are getting life insurance until they’re 80, but you’ve read Error Margin so you laugh in their face, approach your friendly local neighbourhood reinsurance company and sell them a life insurance policy on yourself for a juicy 28k, travel back to the year 1995, head to the cinema to watch Toy Story, then find your 25yo self and force them at gunpoint to take out life insurance until they’re 80. Congrats my healthy non-smoking Indian male friend, you just locked in a nearly 6k risk free profit for an instantaneous 25% return. Do this 31 times and you’ve earned yourself 1000x your capital and probably some questions from the insurance company.

OK but I don’t live in India?

No problem, are you perhaps a 50yo healthy male British non-smoker? I'll spare you the maths but you can do the arb too. 30 years of £100k insurance at age 30 costs you £2084. 10 years at age 50 costs you £2282 for a 9.5% return if you time travel.2

It's hard to find good publicly available data on this but I initially stumbled upon it when looking for life insurance for myself, which makes me think it's not just cherry picked.

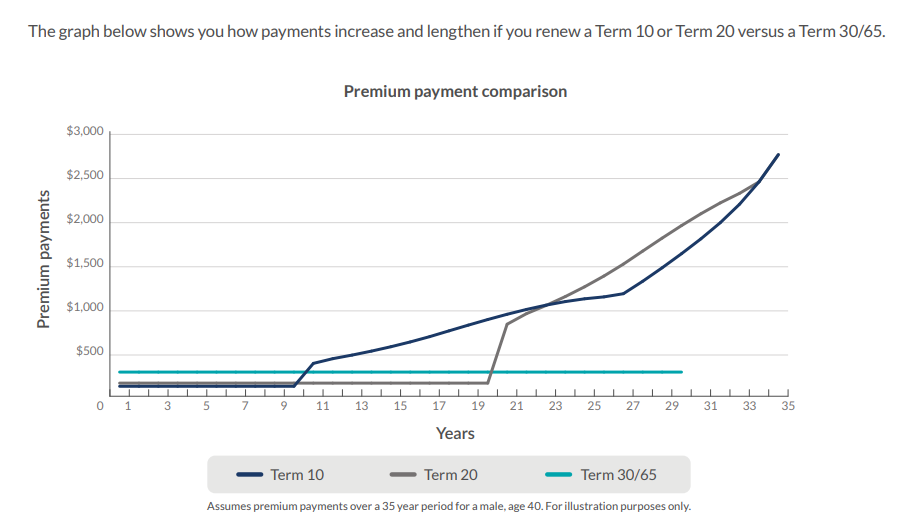

Also, Canadian insurer Equitable published this graph that makes a similar point visually. It’s not quite the same exact thing because their premiums aren’t fixed for the whole term when you renew, but if I’m reading this correctly then the total cost of a 10 year term when you’re 60 is the area under the navy line from year 20 to 30, which is higher than the area under the whole cyan line of your (initially higher) premiums if you take the 30 year term at age 40.3

Weirdly enough, I couldn’t recreate this with the US data from Nerd Wallet. Is there a reason for this? Almost certainly. Do I know what it is? Nope. Do I think it’s because actual time travellers arbed the US market? No comment.

This might be to do with regulatory differences between countries in how much risk the insurance companies are able to take with their investments, but this would require the US to be unusually strict in its regulations, which seems pretty unlikely. I’d be interested to hear any theories to explain this.

But what about the efficient markets hypothesis?

OK well for starters this isn't really a market. Even if it was, it's very difficult to short — you need a time machine and the ability to sell life insurance on yourself, so there’s no mechanism to correct this.

But this may actually make more sense than it seems to at first. I’ve read4 that insurance companies make only small profits on premiums minus payouts after accounting for operating expenses, and the way they top this up is by investing the premiums until they need the cash. So the insurance company genuinely does have more opportunity to make money if you start young and take out a long contract. The returns of 25% and 9.5% I quote above only annualise out to 0.75% and 0.43% respectively given the 30y and 20y timescales involved.5

But… I don’t have a time machine?

I never said arbitrage was easy!

I guess the takeaway for those of us stuck in the 2020s is that as a consumer holding off on life insurance when you’re young may actually cost you more in total over the long run. This is obviously not financial advice, and I’m sure rules and regulations will make this differ a lot by country, but when getting life insurance it may be worth considering how old you’re going to be when it renews, and whether you can optimise the length of your term to minimise total cost to whatever age you want cover for.

B.b.b..but… where’s the rest of your blog?

Work in progress! I wanted to get at least one post out ahead of the ACX announcement of the prediction contest winners. I expect to post maybe 5 - 10 more things from my backlog over the next few weeks, then you’ll be at the mercy of whenever I have blog-worthy thoughts. Please subscribe to my mailing list for forecasting, scientific self-experimentation, video games, and lots of analysis of random interesting bits of data I come across in the wild. Also a post mortem of the 2024 ACX Prediction Contest, though if you want to skip the wait please check out this awesome post from my co-conspirator.

Courtesy of Aviva India, because it had the most extreme example I could find.

Data source, you can get these numbers from the two different tables in the article.

I can’t find the original source but I feel like I’ve heard this in a few different places. Here’s a replacement source that gestures in the same direction.

These returns numbers aren’t really especially related to any numbers of consequence for either the insurer or the time traveller. The former is getting paid in small instalments over time and can decide what to do with the money, and the latter doesn’t even need capital if they sell insurance before buying it. But it’s a useful back of the envelope sanity check all the same.

Looking forward to reading more of your posts?

Selection effect? People who buy life insurance in their 20s are probably not into motorcycles